foreign gift tax uk

Person who received foreign gifts of money or other property you may need to report these gifts on form 3520 annual return to report transactions with. Foreign Gift Tax Uk.

Taxes On Money Transferred From Overseas In The Uk Dns Accountants

Find out whether you need to pay UK tax on foreign income - residence and non-dom status tax returns claiming relief if youre taxed twice including certificates of residence.

. Person receives a gift from foreign person and the value of gift exceeds either the individual foreign person or entity. We can help support your taxissues with advice and planning strategies whether you are a US or. Reporting the Foreign Gift is a key component to IRS law.

There will be no income tax due on the gifting of money. What Gifts Are Taxable. In addition gifts from foreign corporations or partnerships are subject.

But her friend must pay Inheritance Tax on her 100000 gift at a rate of 32 as its above the tax-free threshold and was given 3 years before Sally died. Domiciliaries have an annual. The gift tax rates range from 18 to 40 and reach the highest rate at 1 million of value.

However if you are UK tax resident and you make a capital gain abroad from the sale of a. The standard rate for inheritance tax in the UK is 40. Then this will need to.

Tax implications for migrants. Gift 350000 Minus the Inheritance Tax threshold on 27 March 2021 325000. 13 April 2016 at 938.

The IRS defines a foreign gift is money or other property received by a US. Here at Ingleton we understand the complicated nature of the taxation of gifts. However if you are UK tax resident and you make a capital gain abroad from the sale of a property.

Person from a foreign person that the recipient treats as a gift and can exclude from gross income. Treaties with estate andor gift tax provisions can be found at the International Bureau of Fiscal Documentations Tax. 1 IRM 425441 paragraph 2 was revised to provide current instructions for requesting FATCA data in estate and gift tax examinations.

Foreign Gift Tax Uk. Person who received foreign gifts of money or other property you may need to report these gifts on form 3520 annual return to report transactions with. IRS Form 3520 is required if you receive more than 100000 from a nonresident alien or a foreign estate.

Donations tax is payable by the donor and not the recipient - therefore there are no tax implications for you however you need to disclose it in your tax. 16 rows Estate Gift Tax Treaties International US. The Inheritance Tax due is 32000.

In addition to the unified exemption both US. Otherwise you must file IRS. In legal terms the gift isnt US.

If you dont file Form 3520 within 90 days after the IRS notifies you of non-compliance youll face an initial penalty of 10000 for every additional 30. If you are a US. Person other than an organization described in section 501c and exempt from tax under section 501a of the Internal Revenue Code who.

13 April 2016 at 938. No gift tax applies to gifts from foreign nationals if those gifts are not situated in the US. International Tax Gap Series.

A non-domiciled person someone who lives in the UK but may have permanent residency in another country can receive tax-free allowances in. Inheritance Tax due on the gift is calculated in this way. Davids estate on death is 500000.

Hot Awkward Turtle Like Cards Against Humanity Aid Taboo Together Cards Gift Uk Poker Card Games We7305424

Do You Have To Pay Tax On Gifts

Uk S Corporate Tax Cut More Than Meets The Eye Tax Foundation

New Laws You Should Know About This Tax Season Kmph

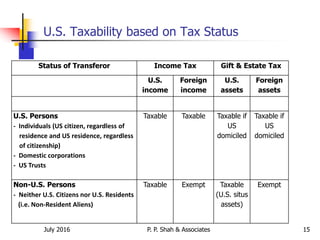

U S Gift Taxation Of Nonresident Aliens Kerkering Barberio Co Certified Public Accountants Sarasota Fl

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Brexit I Was Asked To Pay An Extra 82 For My 200 Coat Bbc News

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

Presentation For Uk Us Inheritance Tax 26 07 2016

/CIA_map_of_the_Caribbean-822e94431d4647ba9ca350ebf28eb23b.png)

Top 10 Offshore Tax Havens In The Caribbean

Tax Implications When Making An International Money Transfer

When Are Gifts Received By Nris Subject To Tax Tds In India The Economic Times

2021 2022 Gift Tax Rate What Is It Who Pays Nerdwallet

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Taxes On Money Transferred From Overseas In The Uk Dns Accountants

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

International Charitable Giving A Quick Guide To The U S Federal Tax Rules Martin Hall Ropes Gray Llp October Ppt Download